Looking for the latest farm tax write-off information? Head to – Farm Shed Tax Write-Off In 2024

Are you hoping to use your farm shed project as a tax deduction? Wondering about the farm shed write-offs available in 2023? Can you write-off a farm shed in 2023?

Over the last few years, there have been several instant asset write-off incentives rolled out.

And these have all had different deadlines and varying requirements for eligibility.

They were also implemented by the previous federal government.

So, what incentives are still available?

What deadlines and requirements do I need to know about?

These are some of the questions we answer in this article!

Read on to learn about the available farm shed write-offs.

Can I Write-Off My Farm Shed In 2023?

Yes, many farm sheds are able to be written off as a tax deduction in 2023 by using either Temporary Full Expensing or the Full Write-Off of Fodder Storage Assets.

But it does depend.

It depends on the eligibility of the asset and the eligibility of your business.

For example, your shed may need to be built before a certain date.

And it also depends on whether the federal government chooses to extend the instant asset write-offs beyond June 30, 2023.

So, with these points in mind, we discuss the asset write-offs currently available along with eligibility requirements and deadlines.

Temporary Full Expensing

Temporary Full Expensing was introduced as part of the JobMaker plan. It was then extended in the 2021-22 Federal Budget, essentially replacing the $150,000 & Under Instant Asset Write-Off.

Where Temporary Full Expensing differs from the previous instant asset write-offs is that there is no capped dollar amount on the asset.

Instead, Temporary Full Expensing allows eligible businesses to instantly write-off the full cost of eligible depreciable assets.

Is your business eligible? Is your asset eligible?

Here’s what you need to know.

Eligible Businesses

Here are some of the criteria that businesses have to satisfy to be eligible for Temporary Full Expensing:

- From 6th October 2020 until 30th June 2023, businesses with a turnover of up to $5 billion are able to deduct the full cost of eligible depreciable assets in the year they are first used and installed.

- Businesses with a turnover of less than $50 million can also apply temporary full expensing to eligible second-hand assets.

Read the full details here and here.

Eligible Assets

Some of the requirements for eligible assets include:

- Assets are to be written off in the year that they are first used and installed. The assets must be installed and ready to use by 30th June 2023.

- Assets can be of any value.

- There are no limits to the amount of assets that can be written off

- The cost of improvements to existing eligible assets can also be written-off from 6th October 2020 to 30th June 2023.

- Examples of eligible assets include machinery sheds, workshops, sheep yard covers, cattle yard covers and shearing sheds.

- Examples of improvements to existing assets include extending your Action machinery shed or cladding a roof-only Action shed.

Read the full details here and here.

Applying Temporary Full Expensing To A Farm Shed In 2023

So, how does Temporary Full Expensing work? How does it reduce your tax?

Simply put, Temporary Full Expensing can help reduce your tax payable by first reducing your taxable income.

Here is a generic example of how it does that:

Kevin’s company, Kevin’s Farms Pty Ltd has an aggregated annual turnover of $20 million for the 2020-21 income year.

On 30th January 2020, Kevin’s Farms Pty Ltd purchases five new Action Steel machinery sheds for $120,000 excluding GST each.

Without temporary full expensing, Kevin’s Farms Pty Ltd would be able to claim a total tax deduction of around $180,000 for 2020-21. The remainder of the cost would be depreciated over future years.

With temporary full expensing, Kevin’s Farms Pty Ltd can claim a deduction of $600,000, the full cost of the five Action machinery sheds.

At the 2020-21 tax rate of 26% for small and medium companies, Kevin’s Farms Pty Ltd will pay around $109,000 less in tax in 2021-22.

Please note this example is a generic example using 2021-22 tax rates and is not a real-life scenario. Seek advice from a qualified accountant on how this could be applied to your business.

What can you do if your business or asset isn’t eligible?

If this is the case, you may be able to take advantage of the Full Write-Off of Fodder Storage assets which is what we discuss next!

Full Write-Off Of Fodder Storage Assets

The full write-off of fodder storage assets is a tax incentive that was introduced several years ago as part of the government’s drought assistance program.

Like Temporary Full Expensing there is no dollar limit placed on assets, but where this incentive differs is that it is specifically for fodder storage assets used to store fodder for the farmer’s own livestock.

And only primary producers are eligible.

Here are some of the other requirements – which you can learn about in detail here

Eligible Businesses

A primary producer to claim a deduction of the full cost of a fodder storage asset provided they meet the following requirements:

- They incurred the expense either

a) On or after 19th August 2018

b) Before 19th August and it was first used or installed ready for use on or after 19th August 2018.

- They mainly use the storage asset to store fodder (see definition of fodder below)

- They use it in a primary production business on land in Australia – even if they are only a lessee of the land.

- The deduction has to be claimed in the year that the expense was occurred

Eligible Assets

An eligible asset is a fodder storage asset that is primarily and principally for the purpose of storing fodder.

Examples of eligible assets include silos, grain bins, hay sheds and grain sheds.

Remember, the main purpose of the fodder storage must be to store fodder for the farmer’s own livestock.

Applying Fodder Storage Asset Write-Off To A Hay Shed (Or Grain Shed)

How does it work?

This tax incentive works the same way as Temporary Full Expensing: It reduces the amount of tax that you are required to pay by reducing your taxable income.

So, that’s an overview of Farm Shed Write-Offs in 2023!

Writing Off A Farm Shed In 2023?

If you are looking to use your farm shed project as a tax deduction in 2023, we recommend ordering and installing your shed prior to June 30.

This is because while these tax incentives have been extended in the past, there has been no indication from the new federal government that this will continue.

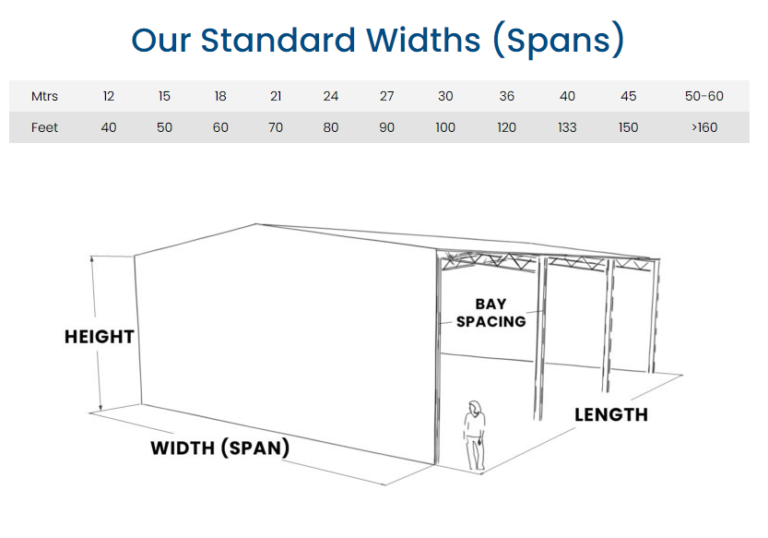

For an idea on current farm shed time frames and prices, browse the resources below.

Useful Resources

- What Is The Lead Time For a New Farm Shed?

- How Much Does It Cost To Build A Farm Shed?

- Latest Farm Shed Brochures

We hope you have found this article on farm shed write-offs helpful! For more articles like this, browse our Learning Hub.

Disclaimer: This article provides general information only and it is not to be used as financial advice, or used to make financial decisions. Consult a qualified accountant to see how this could be applied to your business.