If you are planning a new shed project for this financial year, there are two main government tax write-off incentives that you can take advantage of.

Full Tax Write-Off For Fodder Hay Sheds

Introduced as part of the government’s drought policy, the instant write-off for fodder storage assets allows a primary producer to claim a deduction of the full cost of a fodder storage asset.

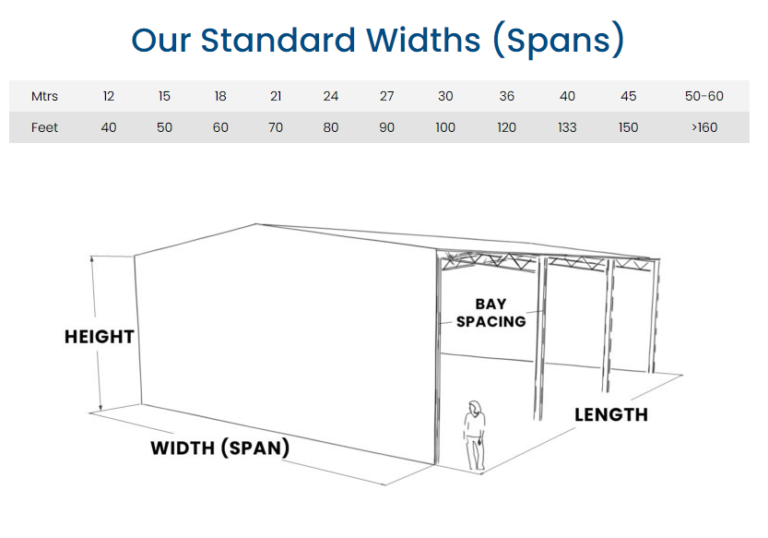

Eligible assets include hay sheds and grain storage shed, provided they meet the needed requirements.

Learn more about the incentive here

Temporary Full Expensing

- From 6th October 2020 until 30th June 2023, businesses with a turnover of up to $5 billion will be able to deduct the full cost of eligible depreciable assets in the year they are first used and installed.

- Assets can be of any value.

- There is no limit to the number of eligible assets that can be written off.

- The assets purchased must be installed and ready to use by 30th June 2023.

- Legislation will need to be passed for the incentive, but it is expected to have the support of the Opposition party.

- The cost of improvements made to existing eligible assets can also be fully written-off from 6th October 2020 to 30th June 2023.

Learn more about this incentive here

*Disclaimer*

Please note that this information is general only. Please consult your accountant before making any financial decisions.