As in previous years, the closer we get to June 30 the more questions there are about the hay shed tax write-off. Or more broadly, the fodder storage asset write-off.

With the number one question being, is it still available?

And the short answer is yes.

But being a government tax incentive, it does come with a list of eligibility requirements – for both the asset and the asset owner.

So, in this article, we seek to answer the top questions about the hay shed tax write-off in 2026.

Disclaimer: Please note that information and examples are general in nature and do not constitute financial advice. To determine your eligibility and tax savings please consult a qualified tax accountant. You can also find additional information at ato.gov.au.

Top Questions About The Hay Shed Tax Write-Off In 2026 – Answered!

1

1. What Is The Hay Shed Tax Write Off?

The hay shed tax write-off refers to the fencing and fodder storage asset write-off introduced by the Federal Government in 2018 as part of drought assistance measures.

This replaced the three-year period (introduced in 2015) for writing off a hay shed, instead allowing eligible assets to be fully written off in the financial year that the expense occurred.

2

2. How Does The Tax Write Off Work?

Put simply, the tax write-off reduces the amount of tax you pay by reducing your taxable income.

How?

Eligible Australian primary producers can deduct the full cost of an eligible fencing purchase or fodder storage asset (like a hay shed) from their taxable income.

By reducing the taxable income, the amount of tax payable is reduced.

Here’s a back-to-basics example, of how this could play out:

- Kevin, a sheep farmer builds a hay shed in November 2025. The shed costs $80,000 and is used to store hay to feed his sheep.

- Kevin’s taxable income in the 2025-2026 financial year is $250,000.

- Using his hay shed as a tax deduction, Kevin can reduce his taxable income by $80,000, reducing it to $170,000.

- As a result, Kevin pays tax on an income of $170,000 rather than $250,000.

Based on the ATO current tax rates and using the ATO simple tax calculator, this would equate to around $34,400 savings.

Disclaimer, please note that is example is general only and calculations do not consider factors such as the Medicare Levy.

3

3. Is It Available For The 2025-2025 Financial Year?

Yes, as per ato.gov.au, “Primary producers can claim an immediate deduction for capital expenses on fencing and fodder storage assets.”

4

4. Am I Eligible For The Hay Shed Tax Write Off In 2026?

As we mentioned earlier, there are eligibility requirements that you need to meet.

Most importantly, “You can’t claim a deduction for fencing and fodder storage assets under these provisions unless you’re a primary producer.”

These deductions are also not available to a partnership.

5

5. Is My Shed Eligible?

There are also eligibility requirements for the fencing or fodder storage assets being written off too.

Here are the key definitions and eligibility requirements for fodder storage assets from the ATO.

- Fodder and fodder storage asset: “A fodder storage asset is an asset that is primarily and principally for the purpose of storing fodder.

A fodder storage asset includes a structural improvement, a repair of a capital nature, or an alteration, addition or extension, to an asset or structural improvement, that is a fodder storage asset.”

- Fodder: “Fodder refers to food for livestock, such as grain, hay or silage. It can include liquid feed and supplements, or any feed that could fit into the ordinary meaning of fodder.”

- Primarily and principally: “For a fodder storage asset to satisfy the ‘primarily and principally for the purpose of’ test, its main purpose must be to store fodder.”

6

6. What Types Of Sheds & Assets Can Be Written Off?

Eligible fodder storage assets could include:

- Silos

- Hay sheds

- Grain bins

- Grain sheds

- Grain bunkers

Eligible fencing assets could include posts, rails, wire, and gates, and other components.

7

7. If I’m Not Eligible, How Else Can I Write-Off My Shed?

There are some alternative ways to use an asset such as a hay shed to reduce your tax payable.

These may include capital works deductions or the $20,000 instant asset write-off.

These will each have their own eligibility requirements that need to be met, and it would pay to check these with your accountant.

Was this article helpful? You may also find the list of resources below useful.

Useful Resources

- Hay Storage Calculator

- Top 3 Hay Shed Sizes For Fodder Storage

- 2026 Steel Prices – Will They Go Up Or Down?

- How To Get More Shed For Your Money

Planning a hay shed project for June 30?

To take advantage of the hay shed tax write-off in 2026, get your shed build underway!

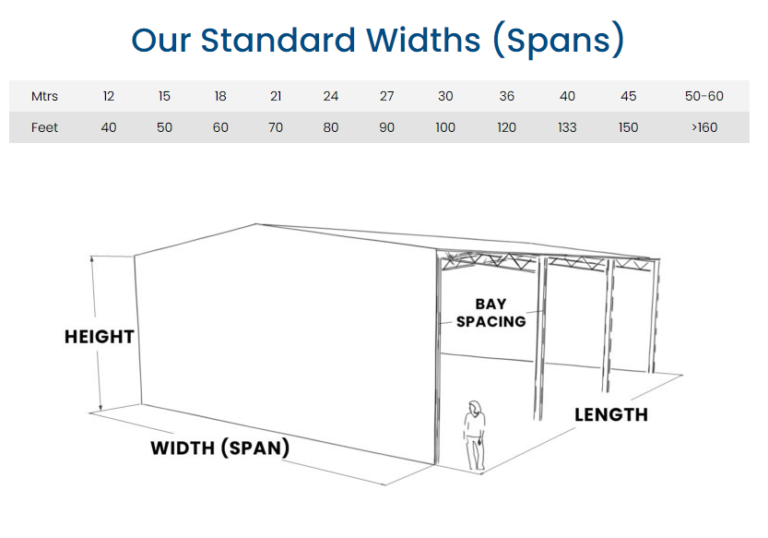

Talk to the Action team about standard hay shed designs, prices and timeframes.

Call 1800 687 888 or submit a REQUEST A QUOTE form and we will be in touch.