Can you still write-off hay sheds? Is the fodder storage asset write-off still available? Can I use this for a hay shed tax write-off?

These have all been common questions recently after Temporary Fully Expensing ended last financial year.

If you are asking these questions too, then this is the article for you.

In this article we discuss the fodder storage asset write-off and provide a refresher on some of the key requirements for a hay shed tax write-off.

First up we discuss what the fodder storage tax incentive is, whether it is still available and how it works.

What Is the Fodder Storage Asset Write-Off?

The fodder storage asset write-off was introduced several years ago by the federal government as part of the drought assistance program.

The incentive allows eligible primary producers to claim an immediate deduction for capital expenses incurred on fencing and fodder storage assets.

How Does Fodder Storage Asset Write-Off Work? Is It Still Available?

- Kevin builds a hay shed to store hay to feed his sheep. The hay shed costs $80,000.

- Kevin’s taxable income is $250,000. Using his hay shed as a tax deduction, Kevin can reduce his taxable income by $80,000, reducing it to $170,000.

- As a result Kevin pays tax on an income of $170,000 rather than $250,000.

Can I Write-Off My Hay Shed? What Are The Requirements?

As we mentioned above, the fodder storage asset write-off can be taken advantage of by eligible primary producers on eligible assets.

So, who is eligible? Who isn’t? What assets are eligible? And what other requirements and information do you need to be aware of?

Here is a summary of the main definitions and eligibility requirements that you need to be aware of.

Fodder Storage Asset

“A fodder storage asset includes a structural improvement, a repair of a capital nature, or an alteration, addition or extension, to an asset or structural improvement, that is a fodder storage asset.”

Fodder

The ATO defines fodder as “food for livestock, such as grain, hay or silage. It can include liquid feed and supplements, or any feed that could fit into the ordinary meaning of fodder.”

Primarily and Principally

Primarily and principally means that the main purpose of the asset must be to store fodder for livestock.

An example provided by the ATO is “if you built a shed for the purpose of storing hay but occasionally use it to store a neighbour’s tractor, it would still meet the ‘primarily and principally’ test because it’s main purpose is to store fodder.”

The ATO provides more examples and information on how this applies to dual purpose assets here.

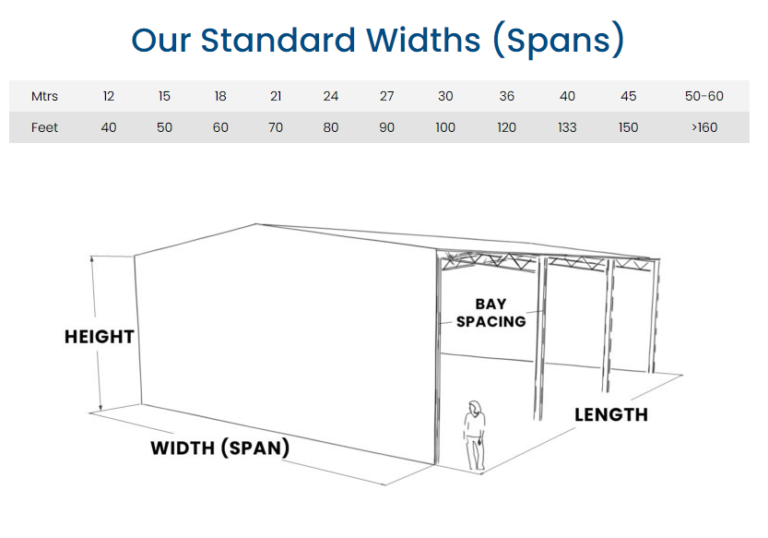

Examples of Eligible Assets

Examples of eligible fodder storage assets include:

- Hay Sheds

- Grain Sheds

- Grain Bunkers

- Grain Bins

- Silos

Deduction Limits

- The deduction you can claim is limited to the capital expenses that you incur for construction, manufacture, installation and acquisition.

- “The expense must have been incurred primarily and principally for use in a primary production business conducted on land in Australia.”

- Different rules will apply to partnership expenses, recouped expenses and second-hand assets.

Visit the ATO website to learn about the eligibility requirements in detail.

What Other Hay Shed Tax Write-Offs Are Available?

If you are unable to meet the requirements for the fodder storage asset write-off, there are some alternative ways to use your hay shed to reduce your tax payable. These could include:

These will each have their own eligibility requirements that need to be met.

Alternatively, while Temporary Fully Expensing is no longer available the instant asset write-off is – now with a $20,000 limit. This can be applied to a wider range of assets that cost $20,000 or less. You can learn about this here.

While this is not yet law, it is intended that “Small businesses, with aggregated turnover of less than $10 million, will be able to immediately deduct the full cost of eligible assets costing less than $20,000 that are first used or installed ready for use between 1 July 2023 and 30 June 2024.”

That’s a wrap on using the fodder storage asset write-off as a hay shed tax write-off!

We hope this article has been helpful in explaining how a hay shed can be written off this financial year.

Below are some more resources and article that you might find useful.

Useful Resources

- 9 Of The Best Hay Shed Kit Sizes (& Price List)

- How To Budget For A Farm Shed Build

- Harvest Storage Guide (Brochure Download)

For more information browse the Learning Hub. To receive information and pricing on your hay shed project submit a REQUEST A QUOTE FORM or give us a call on 1800 687 888.

Disclaimer: This article provides general information only and it is not to be used as financial advice, or used to make financial decisions. Consult a qualified accountant to see how this could be applied to your business.