Here’s what you need to know about taking advantage of the new law for fodder storage assets on your hay shed project.

Read on to learn about the requirements and watch the video below for a generic example of how this incentive can be applied.

Claiming a full deduction

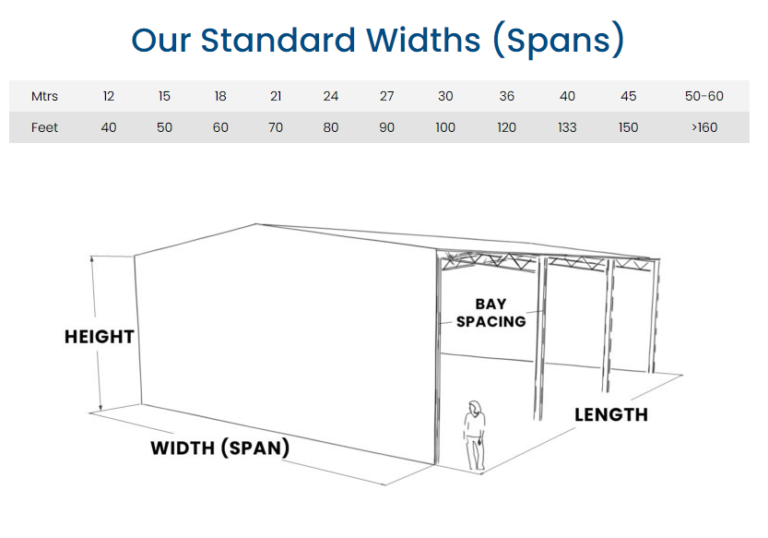

Can I claim a deduction for the full cost of my new Action fodder storage shed/s?

Yes, the new law change allows a primary producer to claim a deduction of the full cost of a fodder storage asset provided they meet the following requirements:

- They incurred the expense either

a) On or after 19th August 2018

b) Before 19th August and it was first used or installed ready for use on or after 19th August 2018.

- They mainly use the storage asset to store fodder (see definition of fodder below)

- They use it in a primary production business on land in Australia – even if they are only a lessee of the land.

- The deduction has to be claimed in the year that the expense was occurred.

FAQ

What can I deduct from a fodder storage asset purchased in previous years?

According to the ATO, for a fodder storage asset purchased:

- From 7.30pm AEST, 12 May 2015 to 18 August 2018 – deduct one-third of the amount in the income year in which you incurred the expense, and one-third in each of the following two income years.

- Before 7.30pm AEST, 12 May 2015 – deduct an amount for its decline in value based on its effective life.

We recommend you ask your accountant or financial advisor for a more detailed explanation before making any decisions.

Are these deductions available in a partnership?

No, these deductions are not available to a partnership. Costs incurred by a partnership are allocated to each partner, who can then claim the relevant deduction in respect of their share of the expense. More on this here

How are ‘fodder’ and a ‘fodder storage asset’ defined?

The ATO defines fodder as: “Food for livestock, such as grain, hay or silage. It can include liquid feed and supplements, or any feed that could fit into the ordinary meaning of fodder.”

A fodder storage asset is defined as “an asset that is primarily and principally for the purpose of storing fodder.” It can also be “a structural improvement, a repair of a capital nature, or an alteration, addition or extension, to an asset or structural improvement, that is primarily and principally for the purpose of storing fodder.”

What is meant by “primarily and principally”?

The main purpose of the fodder storage must be to store fodder for the farmer’s own livestock.

Examples of situations that would and wouldn’t satisfy the “primarily and principally” test.

Other than hay sheds, what other fodder storage assets would be eligible?

Eligible storage assets, other than hay sheds, include:

- Grain sheds

- Silos

- Liquid feed supplement storage tanks

- Grain bins

- Above-ground grain bunkers

*Disclaimer* Please note that this advice is general only and examples used are general in nature. Speak to a qualified accountant to find out how this would apply to your business.