There has been a lot of commentary and questions around steel prices recently, and they mostly centre around: Why are steel prices so high?

If you have purchased any farm machinery, fences or infrastructure such as farm sheds or silos over the past two years, you have probably asked the same question – which is understandable. Steel prices in Australia have been on the rise for a few years now and show no sure signs of stopping.

What is causing the price increase – and is there anything we can do about it? Keep reading to find out, or if you prefer watch the video below.

Why are steel prices so high?

To answer this question, we first need to understand that there are an array of factors and flow-on effects that are influencing the price of steel both globally and locally – such as the impact of the global Covid-19 pandemic on the supply chain.

Some of the key reasons for the increase in global and local steel prices include:

- An increase in the price of iron ore. This was initially largely driven by economic stimulus packages and incentives from governments. These were introduced to help economies recover from the effects of the Covid pandemic and resulted in increased spending on infrastructure projects. It is also important to note that Brazil was heavily impacted by the pandemic, and because the nation is the second largest iron ore producer in the world, this placed greater demand and stress on the Australian iron ore exports.

- An increased demand for steel. Again, government incentives, and a shortage of timber for building projects created a widespread demand for steel, increasing prices.

- A backlog of steel orders due to existing and planned infrastructure projects (for example the Inland Rail Project or Melbourne Metro Tunnel) was exacerbated by continuing labour shortages due to Covid-19 lockdowns and isolation protocols – this combination has meant that supply has not been able to catch up with demand

- Other global shipping, trade and production disruptions have also had a significant

impact.

For example, when Beijing hosted the 2022 Winter Olympics, steel factories around Beijing were shut down to reduce the level of smog and pollution in the air.

Disruptions like this mean that the demand for Australian Steel increases as companies who don’t usually source Australian Steel are forced to shop in the local market, decreasing supply and affecting availability – and meaning prices stay consistently high or even increase.

The Russian invasion of Ukraine is another current example. The Russian attacks have caused further global instability in steel pricing, in particular affecting Azovstal steelworks, the biggest steel producers in Europe.

- Another factor worth noting is the limited supply of coking coal (due to greener alternatives becoming more popular) and subsequent price rise.

So, that is a brief overview of how a variety of factors, many of which are connected, are increasing the price of steel. Keep reading as we delve deeper into imported steel, Australian-made steel and what consumers and companies can do about it.

Imported Steel

To better understand the recent steel prices, it is important to understand the global steel market and what influences the prices of steel.

Firstly, the global steel market is extremely volatile, and this volatility is generally reflected in the prices we pay for steel. This is because Australia has always been a net importer of steel, meaning that we import more steel than we export – about one-third of Australia’s steel needs are imported, with large volumes coming from Chinese mills.

The price of imported steel is determined by a number of contributing factors, including international prices and the movement of the US dollar.

Because steel is a global commodity, its price is affected by the movements in the global market – the closure of the Beijing steel factories is an example of this. Similarly, when the US dollar is strong, it becomes more expensive for other countries to buy American steel, which pushes up the price of steel sourced from other countries like China.

As a net importer, this means we are vulnerable to global price fluctuations – when the price of steel goes up, we pay more.

Imported steel prices also increase due to taxes and tariffs. Australia has a very high manufacturing import tax, known as a tariff. This tariff is a tax on imported goods, like steel, and is designed to protect local businesses (in this case steel producers) from foreign competition.

Australian-Made Steel

It is not just the price of imported steel that has been impacted, the price of Australian-made steel has also been affected.

The majority of steel production in Australia takes place in New South Wales, with Bluescope Steel being the biggest producer.

As we have already discussed, Covid-19 has had a significant impact on the global steel market – and Australia has been no different. Bluescope, like steel producers right around the world, were forced to shut down their plants or operated with limited staff and reduced capacity.

Steel producers also reduced production because the initial consensus about the impact of the pandemic was that construction would slow down – however, the opposite occurred. The construction industry experienced increased growth, causing demand to outstrip supply, delaying steel supply and increasing prices.

Other factors that have affected local steel supply are incidents like the recent floods that impacted supply lines and transport, delaying deliveries and contributing to increased lead times. Factors like these all contribute to the cost of productions, which pushes prices up.

How Steel Price Increases Impact The Consumer. What Can You Do About It?

Increased production costs are inevitably passed onto the consumer, and the recent steel prices have been no different as evident in the increased prices of products we use every day – from cars and appliances to construction materials.

Steel is a vital component in many of the products we use every day. So, what can you – the consumer – do about it? There are a number of steps that Australian costumers can take to help offset the high cost of steel.

Steps consumers can take include shopping around for the best price, using alternative materials where possible, renegotiating contracts with suppliers, getting a better understanding of the market to avoid being caught by price fluctuations and making sure you budget for price increases.

What Are We Are Doing About It?

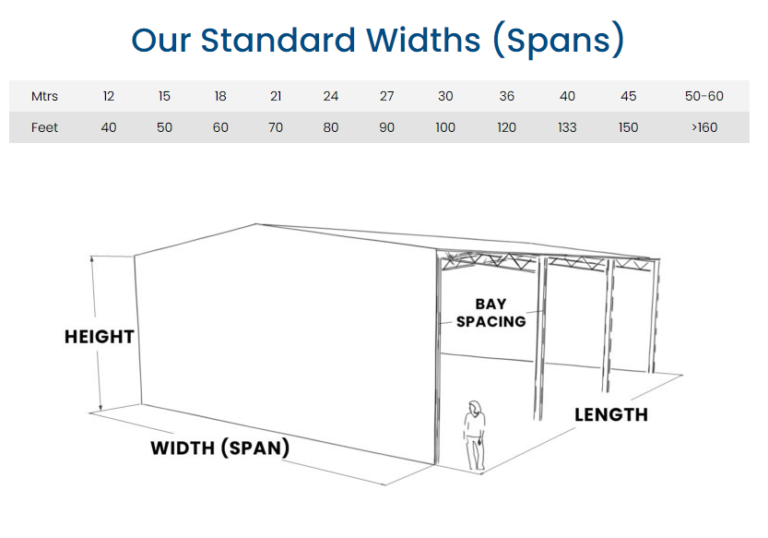

As a heavy-duty steel farm shed manufacturer, we too are impacted by the increased price of steel – so what are we doing about it?

Our approach to recent steel price rises is to be proactive and we have taken steps to minimise the impact of rising steel costs for our customers. This includes buying steel in advance and holding more store, as well as negotiating with our suppliers for better prices. We understand that these steel price increases are impacting our customers, and we’re doing everything we can to keep costs down – and passing these savings onto our customers.

We hope this article helps you understand why steel prices – and thus shed prices – have increased. The next question we are usually asked is: When will steel prices come down?

When will steel prices come down?

While we don’t have the ability to look into a crystal ball and see into the future (if only!), we can share some market observations and industry insights that will influence when steel prices will come down.

While there is industry speculation that steel prices will plateau and eventually come down, there is no clear-cut answer to this question unfortunately. For example, with a recent drop in iron ore prices, it was expected that these price rises would stop, and the price of steel would come down, too. Instead, steel prices have continued to rise, albeit by smaller percentages.

Some factors that will potentially help steel prices to come down include increased production once labour issues are resolved, steel suppliers selling excess stock once supply has improved, an alternative or new and reliable steel supplier emerging or a decrease in demand.

It is difficult to put a timeframe on any of these incidences, though. While there is optimism that steel prices will return to pre-Covid levels by the end of the year, there is no guarantee that this will happen, particularly with events like the Russian invasion of Ukraine contributing to an already uncertain situation.

In the meantime, rest assured that we are actively securing supply of Australian-made steel for our sheds and negotiating prices with our suppliers.

For more articles like this, visit our Learning Hub and subscribe to our newsletter to stay up-to-date with latest industry news and helpful tips.